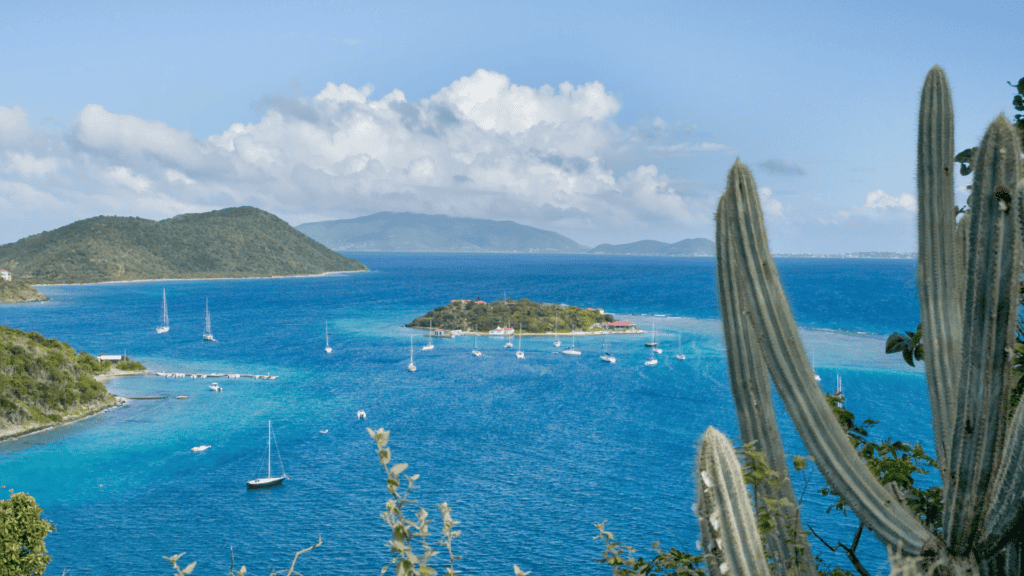

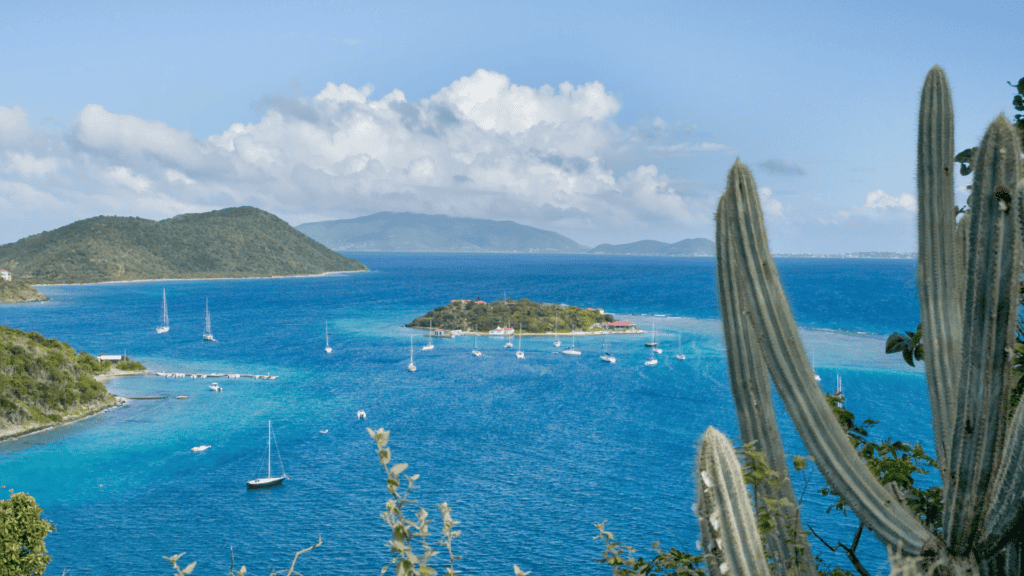

Mastering the Economic Substance Rules in the British Virgin Islands

The British Virgin Islands (BVI) introduced Economic Substance rules with The Economic Substance (Companies and Limited Partnerships) Act, 2018, which came into force on January 1, 2019. In addition, to supplement the Act, the BVI introduced Economic Substance Rules on October 9, 2019. BVI Legal Entities The Act imposes Economic Substance requirements on BVI legal […]

Mastering the Economic Substance Rules in the British Virgin Islands

The British Virgin Islands (BVI) introduced Economic Substance rules with The Economic Substance (Companies and Limited Partnerships) Act, 2018, which came into force on January 1, 2019. In addition, to supplement the Act, the BVI introduced Economic Substance Rules on October 9, 2019. BVI Legal Entities The Act imposes Economic Substance requirements on BVI legal […]

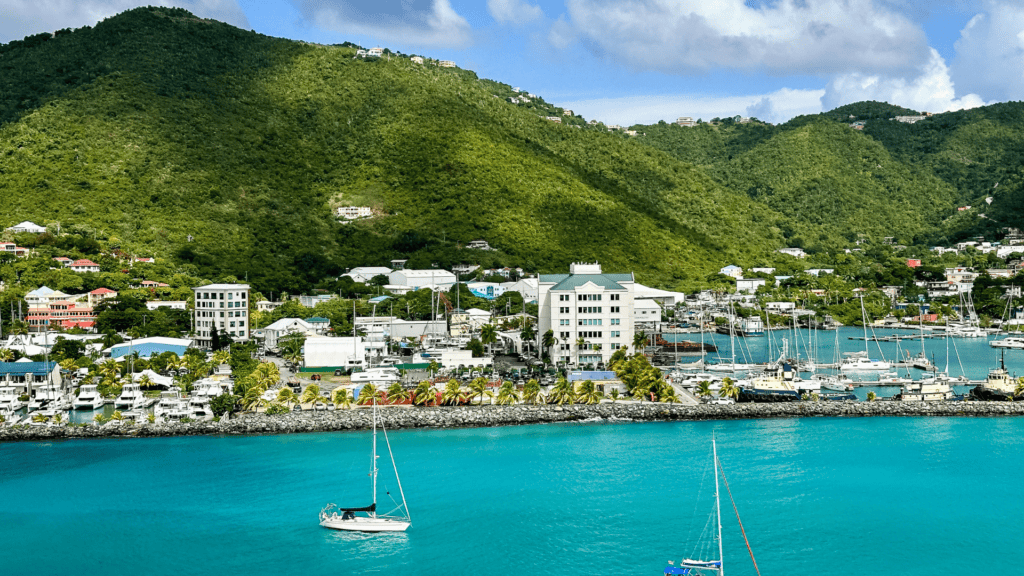

BVI Annual Return: Master Your Financial Reporting Obligations

Effective January 1, 2023, BVI corporations are now obligated to provide a balance sheet and income statement in the form of a BVI Annual Return to their Resident Agents. In the ever-evolving landscape of corporate compliance, staying on top of financial record keeping is paramount, and this is particularly true for BVI corporations given the […]

The Corporate Transparency ACT

The Corporate Transparency Act (the “CTA”) was adopted by Congress on January 1, 2021, and will enter into effect on January 1, 2024. The Treasury promulgated Final Regulations on September 29, 2022. Information to be Reported on the Corporate Transparency Act The CTA and the Final Regulations require the Reporting Company to file with FinCEN […]

Understanding Child Support & Trusts: South Dakota Supreme Court Ruling in Cleopatra Cameron Gift Trust Case

Supreme Court of South Dakota In re CLEOPATRA CAMERON GIFT TRUST CASE 931 N.W.2d 244 (2019) In a California divorce proceeding, a California family court imposed interim child support obligations on Cleopatra Cameron, and joined the trustee to facilitate the payment of these support obligations. The family court subsequently ordered the trustee to make direct […]

Exploring Limited Liability Companies (LLCs) in South Dakota

South Dakota, known for its stunning natural landscapes, has also made a name for itself in the world of business. One significant aspect of this is the creation and operation of Limited Liability Companies (LLCs). South Dakota’s approach to LLCs is unique, combining the best features of corporations and partnerships while also offering several advantages […]

BVI Investment Funds: A Comprehensive Guide to Fund Vehicles and Compliance

Discover the advantages of British Virgin Islands (BVI) Investment Funds, governed by the Securities and Investment Business Act, 2010. From Open-Ended Funds, including Public, Professional, Private, Approved, and Incubator Funds, to Closed-Ended Funds like Private Investment Funds (PIFs), explore diverse fund structures and functionaries. Learn about compliance essentials, valuation policies, asset safekeeping, and reporting obligations […]

Ontario Limited Partnerships: Structure and Compliance Essentials

Ontario Limited Partnerships (OLPs) offer a flexible and transparent business structure under the legal framework of Canada’s Ontario province. Designed for managing assets and investments, OLPs consist of General Partners (GPs) and Limited Partners (LPs) with distinct roles and responsibilities. GPs, typically corporations, handle the OLP’s administration, while LPs enjoy limited liability protection. In this […]

Exploring Scottish Partnerships: Features and Legal Aspects

Scottish partnerships offer a unique legal framework that sets them apart from traditional partnerships. With distinct legal personality, these partnerships provide numerous advantages, allowing assets to be registered in the partnership’s name and enabling contractual arrangements on behalf of the partnership itself. Whether limited or general, each type of partnership comes with its own set […]

A Guide to Swiss Corporations: Taxation and Key Considerations

Swiss corporations benefit from a favorable tax regime that has long positioned Switzerland as an appealing destination for businesses. Effective January 1, 2020, the tax system underwent significant revisions, introducing a unified structure across various regimes. This guide delves into the aspects of corporate income taxation, withholding tax, corporate vehicles, and more that are critical […]