Turkey’s Tax System – Country Profile

Turkey’s tax system balances moderate corporate taxation with progressive personal income taxes. With a 20% corporate tax rate (25% for financial companies) and personal income tax rates reaching up to 40%, Turkey offers a structured and evolving framework. Gift and inheritance taxes are in place, but there is no wealth tax. Turkey aligns with international […]

Saudi Arabia’s Tax System – Country Profile

Saudi Arabia offers one of the most tax-friendly environments, with no personal income, inheritance, gift, or wealth taxes. While foreign businesses pay a 20% corporate tax, local and GCC investors are subject to Zakat instead. The country also levies a 15% VAT but has a streamlined tax framework, making it attractive for both individuals and […]

Qatar’s Tax System – Country Profile

Qatar’s tax system is one of the most business-friendly in the world, featuring no personal income, inheritance, gift, or wealth taxes. While Qatari-owned corporations enjoy full tax exemptions, foreign-owned businesses are subject to a modest 10% corporate tax, with higher rates for oil and gas activities. The country’s commitment to financial transparency is reflected in […]

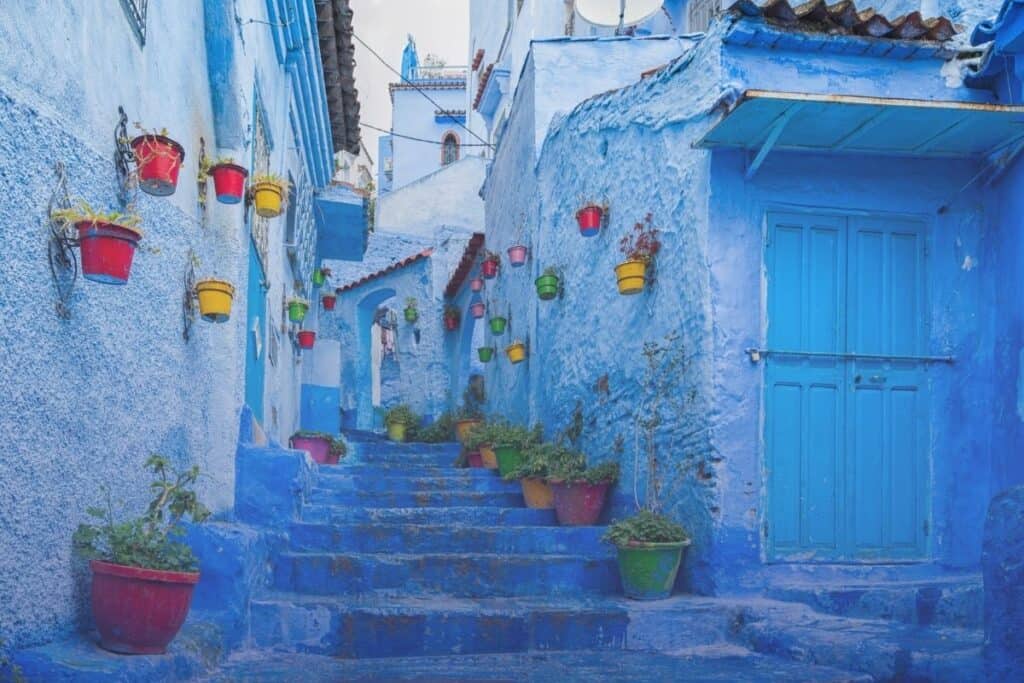

Morocco’s Tax System – Country Profile

Morocco’s tax system follows a territorial approach, meaning residents are taxed only on income earned within the country. Corporate tax rates go up to 32% for high-income companies, while personal income tax is progressive, reaching up to 38%. Unlike many countries, Morocco does not impose gift, inheritance, or wealth taxes. With strong international agreements for […]

Lebanon’s Tax System – Country Profile

Lebanon’s tax system is a mix of progressive personal taxation and moderate corporate tax rates. Individuals pay between 4% and 25% on local income, with capital gains and dividends taxed separately. Corporate tax is set at 17%, while inheritance and gift taxes range from 3% to 45%. Despite its structured tax laws, Lebanon’s financial system […]

Kuwait’s Tax System – Country Profile

Kuwait’s tax system is one of the most favorable in the world, with no personal income, inheritance, gift, or wealth taxes. Local businesses also benefit from zero corporate tax, while foreign companies face a flat 15% rate. Despite the lack of formal anti-avoidance rules, Kuwait maintains global financial transparency through its extensive Double Tax Treaty […]

Jordan’s Tax System – Country Profile

Jordan’s tax system follows a territorial approach, taxing only income sourced within the country. With personal income tax rates ranging from 5% to 30% and a standard corporate tax rate of 20%, Jordan offers a relatively straightforward tax structure. Notably, there are no wealth, inheritance, or gift taxes. While Jordan lacks formal anti-avoidance and transfer […]

Egypt’s Tax System – Country Profile

Egypt’s tax system offers a straightforward and relatively low-tax environment. Corporate income tax is set at 22.5%, while personal income tax follows a progressive structure, ranging from 2.5% to 25%. Notably, Egypt does not impose inheritance, gift, or wealth taxes, making it appealing for businesses and individuals alike. The country follows OECD guidelines for transfer […]

Bahrain’s Tax System – Country Profile

Bahrain’s tax system offers one of the most tax-friendly environments globally, with no personal income, corporate, inheritance, gift, or wealth taxes for most sectors. The only exception is the oil and gas industry, which is taxed at 46%. Bahrain also applies a modest 5% VAT, making its tax framework both simple and business-friendly. Supported by […]

United Arab Emirates’ Tax System – Country Profile

The United Arab Emirates’ tax system presents a unique landscape for both individuals and corporations, characterized by several attractive tax incentives. This overview explores the intricate details of taxation within the UAE, where personal income, inheritance, and gift taxes are notably absent, reflecting the country’s approach to fostering a prosperous economic environment. At the heart […]