Trusts are powerful instruments used in estate planning, tax optimization, and asset protection. As a common law concept, Trusts facilitate the transfer of legal title from the settlor to the trustee, who then manages the assets for the benefit of the beneficiaries. In this brief article, we’ll explore the key elements of Trusts, the roles of involved parties, and the various types of Trusts that can be established to suit one’s unique objectives.

Nature

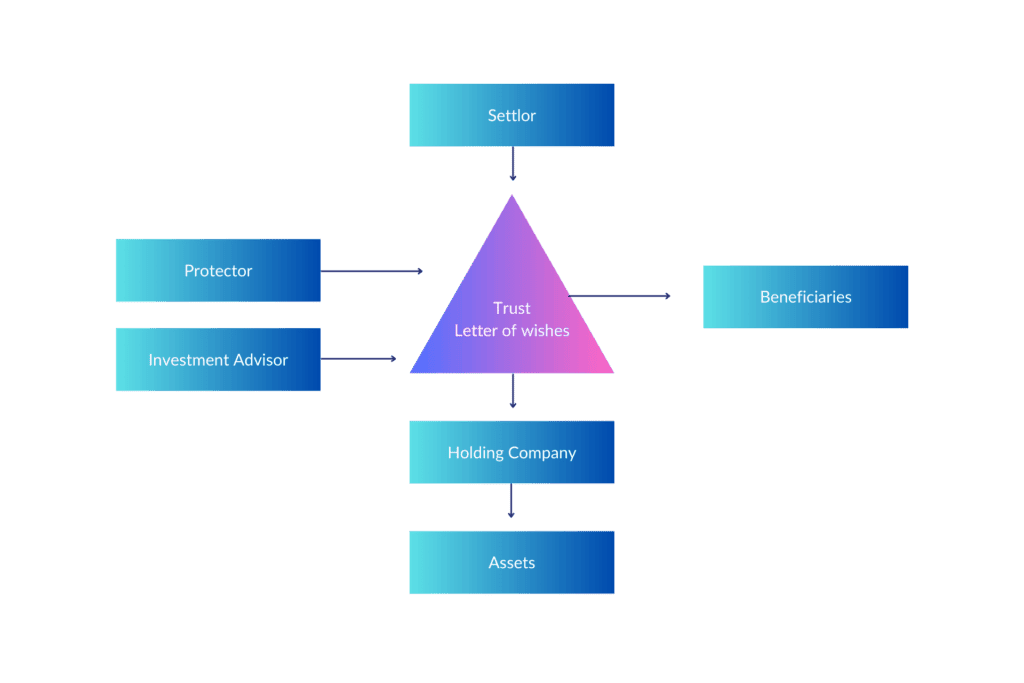

Trusts are common law instruments, which do not have legal personality, under which the settlor transfers legal title to the assets to the trustee on specified terms, who holds the assets for the benefit of the beneficiaries, who in turn hold equitable title to the assets. In short, the trustee receives assets from the settlor, and is required to hold and distribute them to the beneficiaries as provided for in the trust.

Principal Objectives

Trusts are typically established to achieve estate planning, tax planning, and asset protection objectives.

Types of Trusts

Trusts can be revocable, which means the settlor preserves the power to revoke and terminate the trust, or they can be irrevocable, where the Settlor has no power to revoke or terminate the trust. In addition trusts distributions can be at the discretion of the trustees, or fixed interest where the distributive scheme is established in the trust instrument.

The Settlor

The Settlor is the person who executes the Trust instrument and contributes the assets to the Trust. The Settlor may reserve certain powers over the administration of a Trust, including a beneficial interest, the power to approve distributions, change Beneficiaries, remove the Trustee, manage the Trust assets, revoke the Trust, etc. However, reserving such powers may serve to significantly reduce tax advantages and asset protection advantages.

The Trustee

The Trustee holds legal title to the assets, and is charged with giving effect to wishes of the Settlor, executing the terms of the Trust, and protecting the interests of the Beneficiaries. In a discretionary Trust, the Trustee is given wide discretion over Trust administration, including distributions to Beneficiaries. The Trustee is also obliged to keep proper accounts, etc.

Beneficiaries

The Beneficiaries hold equitable interests in the Trust, and are named in the deed. Beneficiaries may include the Settlor, his/her family members, as well as third parties.

Protector

The typical role of the Protector is to exercise certain powers defined in the Trust instrument, such as appointing and removing the Trustees, and appointing and removing the Investment Advisor, as well as consenting to the exercise of certain Trustee powers and discretions, such as distributions of income and principal, adding and removing Beneficiaries, amending the Trust instrument, etc. The Protector is usually appointed and removed by the Settlor.

Investment Advisor

The Investment Advisor named in the Trust instrument has the responsibility of managing the assets of the Trust. Trust instruments in modern trust jurisdictions grant the Investment Advisor the power to direct the Trustee as to investments, which directions must be followed by the Trustees.

Trust Documents

The Trust instrument is the principal Trust document which contains the terms of the Trust arrangement, including names of the Beneficiaries, powers of the Settlor, the dispositive provisions, as well as the powers and discretions of the Trustee, etc. The Letter of Wishes (LOW) typically accompanies discretionary Trusts and provides guidance to the Trustee on trust administration and application of the Trust fund.

Governing Law

Trust instruments typically contain express governing law clauses which stipulate the law applicable to the Trust, such as the laws of England and Wales, or modern jurisdictions, such as Cayman, Bahamas, South Dakota, etc.

Trust Assets

Trusts can hold any type of assets, normally through underlying holding companies, including financial assets, real estate, yachts and aircraft, operating companies, etc.

In conclusion, Trusts serve as invaluable tools in achieving estate planning goals, protecting assets, and optimizing taxes. Whether you opt for a revocable or irrevocable Trust, fixed interest or discretionary distributions, the careful consideration of the roles of the Settlor, Trustee, Beneficiaries, Protector, and Investment Advisor plays a vital role in shaping the success of your Trust.

As you navigate the complexities of Trust planning, remember that each Trust is uniquely tailored to suit individual circumstances and objectives. Our team of experts at CISA Trust is here to guide you every step of the way, from crafting the perfect Trust instrument to selecting the most suitable governing law. Let us help you build a secure financial future with Trusts that align with your aspirations.

Reach out to us today, and together, we’ll safeguard your assets and preserve your legacy for generations to come.