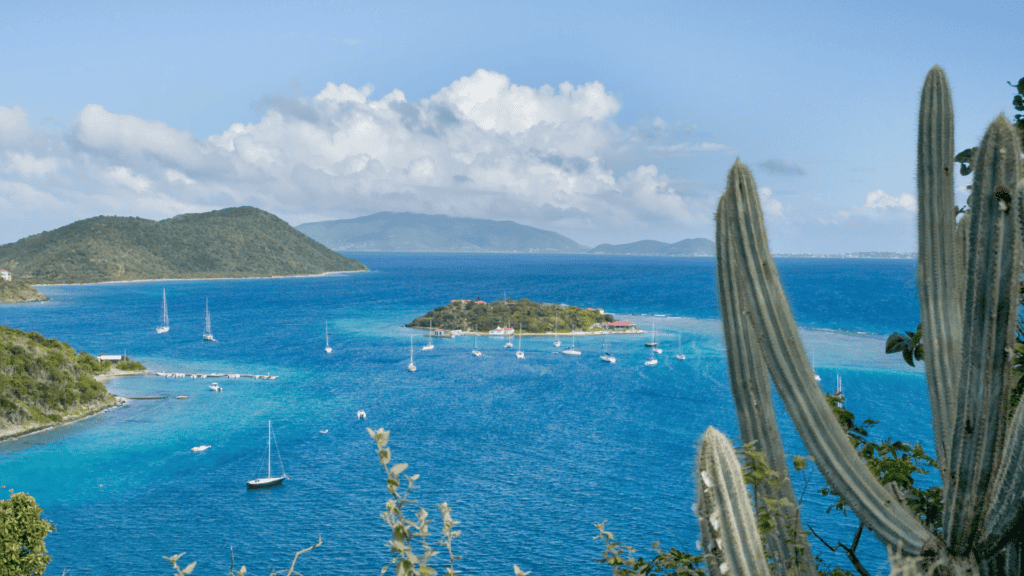

Tortola

British Virgin Islands

British Virgin Islands

Trust and Company Management Services

The British Virgin Islands (BVI) is one of the most widely used offshore jurisdictions for trust and company administration, which has innovative and flexible laws. The BVI is a British Overseas Territory (OT). The legal system of the BVI is based on English common law, and appeals from local and regional courts ultimately lie with the Privy Council in the United Kingdom.

CISA Trust Company (BVI) Ltd.

CISA BVI is a fully independent and privately-owned trust company dedicated exclusively to providing trust, company management, and related services. The company was incorporated in 2010. CISA BVI has affiliated trust companies in South Dakota, Switzerland, and a marketing affiliate in Miami.

CISA BVI holds a Class 1 Trust License in the BVI, and is authorized to provide trust, company management, and resident agent services. CISA is subject to licensing and supervision by the Financial Services Commission.

BVI Trust Services

CISA BVI provides a full range of trust services in the BVI, including revocable trusts, irrevocable trusts, discretionary trusts, fixed interest trusts, and VISTA trusts. CISA also offers Private Trust Companies and Purpose Trusts.

The trust laws of the BVI are set-forth in the Trustee Ordinance (1961), and the various amendments. The maximum trust period is 360 years. The BVI has reserved powers legislation, which allows the settlor to reserve certain powers without invalidating the trust. The BVI law contains firewall provisions which require BVI law to be applied to all matters concerning the trust, and shields trust assets from foreign law claims arising from personal relationships (matrimonial or community property rights) with the settlor and claims arising from heirship, and prohibits the recognition or enforcement of foreign judgements recognizing such rights. See attachment below.

Company Management Services

CISA BVI offers incorporation and company management services for BVI companies, including directors’ services, as well as BVI partnerships, and incorporation and management services for entities created in other jurisdictions. CISA BVI also provides Resident Agent and Registered Office services for BVI companies under its administration. See attachment below.

Accounting Services

CISA BVI provides book-keeping and accounting services for trusts and entities under administration.

FATCA/CRS

CISA BVI is registered with the IRS as a Foreign Financial Institution (FFI), and provides FATCA support including reporting where required. CISA BVI also provides CRS support and reporting, where required.

Membership

Association of Registered Agents (BVI)

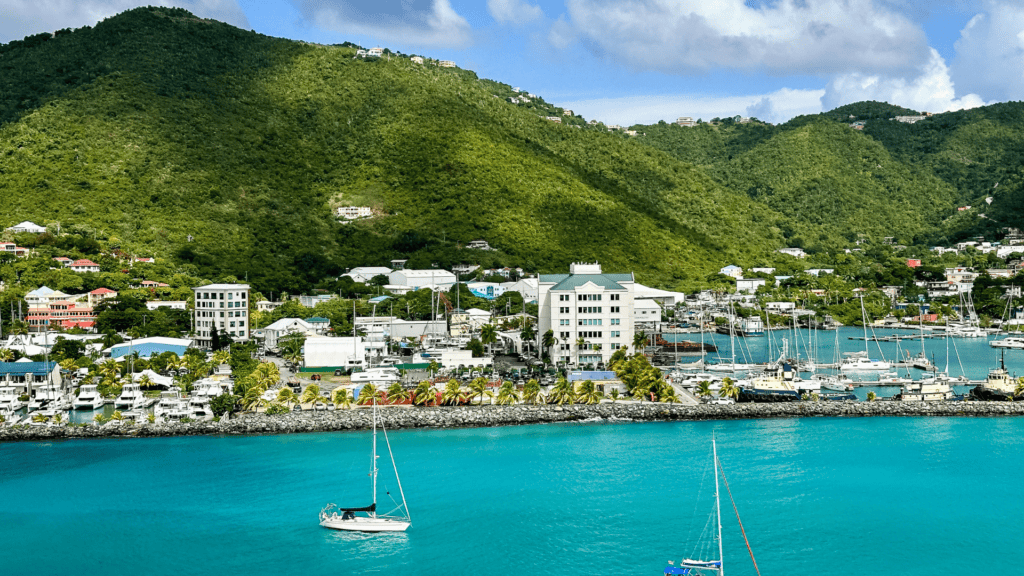

Address

The Old Foundry, 50 Main Street,

PO Box 3252, Road Town, Tortola,

British Virgin Islands

Phone number

+1 284 494 8189

Mailing Address

info@cisatrustbvi.com

- BVI Trust Services

- BVI Trust Laws

- BVI Corporate Laws

Trust Services In The British Virgin Islands

CISA Trust Company (BVI) Ltd. was established in the British Virgin Islands (BVI) in 2010, and provides bespoke trust and company management services to an exclusive international clientele.

Licensing and Supervision

CISA holds a Class 1 Trust License in the BVI, and is authorized to provide trust, company management, and resident agent services. CISA is subject to licensing and supervision by the BVI FSC.

Affiliated Companies

CISA BVI has affiliated trust companies in South Dakota and Switzerland, and marketing affiliates in Miami.

Wealth Planning

CISA BVI provides advice and assistance on the most appropriate types of trusts for succession, tax and asset protection planning.

BVI Trust Laws

BVI trust law is based on English common law and principles of equity, and BVI statutory law, principally the BVI Trustee Act (1961), and its amendments.

The BVI trust period is 360 years, reserved powers are authorized, common law rules apply to the disclosure of information, firewall provisions bar forced heirship claims, but has no have asset protection legislation.

BVI Trust Services

CISA provides a full range of trust services in the BVI, including reserved powers trusts, revocable trusts, irrevocable trusts, discretionary trusts, fixed interest trusts, and VISTA trusts. CISA also offers Private Trust Companies (PTCs) and Purpose Trusts to hold the shares of PTCs.

CISA is typically directed as to investments by an Investment Advisor appointed in the trust deed, and a Protector is typically appointed to exercise certain powers, including powers to change the trustee, and the power to consent to certain trustee actions.

CISA holds a wide range of assets in trust, including financial assets, real estate, operating companies, aircraft, yachts, etc.

Company Management Services

CISA BVI offers incorporation and company management services for BVI companies, as well as BVI partnerships, and incorporation and management services for entities created in other jurisdictions.

CISA offers fully managed BVI companies, including the provision of directors’ services, operation of corporate bank accounts, resident agent services, and CRS and FATCA support services. However, investments are directed by clients or their designees through limited powers of attorney (LPOAs).

Resident Agent Services

CISA BVI offers Resident Agent and Registered Office services for BVI companies under its administration.

Accounting Services

CISA provides book keeping and accounting services for trusts and entities under administration, depending on requirements.

Tax Information Exchange Agreements

The BVI has Tax Information Exchange Agreements (TIEAs) with a number of jurisdictions. Information may also be exchanged under the OECD Convention.

OECD Convention on Mutual Assistance

The BVI is a signatory to the Multilateral Convention on Mutual Administrative Assistance in Tax Matters. The Convention requires signatories to exchange of information “on request”, and authorizes spontaneous and automatic exchange.

Common Reporting Standard (CRS)

The BVI was an “early adopter” of CRS and is a signatory to the Multilateral Competent Authority Agreement (MCAA) to implement CRS for the automatic exchange of account information. The BVI has active automatic exchange of information relationships with a number of counterparties.

FATCA

The BVI has a Model 1 Intergovernmental Agreement FATCA (IGA) in force with the United States for the automatic exchange of account information. CISA BVI is registered with the IRS as a Financial Institution (FI).

Entity Classification Services

CISA Provides support for entity classification under FATCA and CRS, including assistance with completion of W-8BEN-Es and CRS Self Certification Forms.

Taxation

Trusts in the BVI are exempt from taxation.

Trust Laws Of The British Virgin Islands

The British Virgin Islands is a British Overseas Territory (OT). The legal system is based on English common law, and appeals from local courts lie with the Privy Council.

Applicable Trust LawsThe trust laws of the BVI are contained in The Trustee Act, and the various Trustee Amendment Acts, and The Special Trust Act (VISTA).

Trust PeriodThe maximum trust period is 360 years.

Reserved PowersBVI law authorizes reserved powers in favor of the settlor.

Disclosure of Information to the BeneficiariesEnglish common law rules apply. Beneficiaries with vested interests, as well as discretionary beneficiaries, and objects of powers, have rights to information.

Private Trust Companies (PTCs)PTCs are permitted and do not require licensing or supervision but must appoint a BVI Registered Agent which holds a Class 1 Trust License.

Purpose TrustsPurpose Trusts are authorized, which have purposes as objects. The trustee of a BVI Purpose Trust must be licensed in the BVI.

Firewall ProvisionsThe Firewall legislation requires BVI law to be applied to all matters concerning BVI law trusts, and shields trust assets from foreign law claims arising from a personal relationship (matrimonial or community property rights) with the settlor and claims arising from heirship, and prohibits the recognition or enforcement of foreign judgements recognizing such rights.

Asset ProtectionThe BVI has no asset protection legislation. Transfers made with the intention to defraud creditors are voidable at the instance of the creditor, except transfers to bona fide purchasers for value without notice. There is no creditor limitations period to file claims.

Licensing and SupervisionTrust companies in the BVI are subject to licensing and prudential supervision by the Financial Services Commission.

British Virgin Corporations

Corporations incorporated in the British Virgin Islands (“BVI”) are governed by the BVI Business Companies Act 2004.

IncorporationA company is incorporated by the submission of a Memorandum by the proposed Resident Agent as the incorporator, and the issuance of a Certificate of Incorporation by the Registrar. A number of different types of companies can be incorporated under the act, such as companies limited by shares, companies limited by guarantee, unlimited companies, restricted purpose companies, and segregated portfolio companies.

Memorandum and ArticlesThe Memorandum must state the name and type of company, its registered office, and the name and address of the Registered Agent. Companies authorized to issue shares must state the maximum number of shares that can be issued as well as the classes of shares that the company is authorized to issue. Restricted Purpose Companies and Segregated Portfolio Companies must disclose their special status.

Capacity and PowersA company is a separate legal entity, and has power and capacity to undertake any business or enter into any transaction, including issuing shares, debt obligations, and options to acquire shares and debt obligations, guaranteeing liabilities, pledging assets, etc.

SharesShares are personal property, and give the holders the right to vote, and receive an equal share in any dividend or distribution of the surplus assets of the company. The company may issue more than one class of shares, with our without par value, and for such consideration and on such terms as the directors may determine. Companies do not have a minimum share capital. Distributions can only be made if the company will meet the solvency test immediately after the distribution. A Register of Members must be kept.

MembersA company must have one or more members. A member of a limited liability company has no responsibility for the liabilities of the company, and any responsibility is limited to any amount unpaid on shares, any liability provided for in the memorandum and articles, and any liability to repay a distribution. Meetings of members may be called by the directors, and may be held outside the BVI. A quorum requires at least 50% of the votes.

Company AdministrationA company must have a Registered Office in the BVI, and a licensed Registered Agent. The Registered Agent must keep: the Memorandum and Articles; the Register of Members; the Register of Directors; and copies of all notices filed by the company. A company must keep financial records sufficient to show the company’s transactions and enable the transactions to be determined with accuracy, and must retain the records and for at least 5 years. A company must have a seal, and imprint of which must be kept at the office of the Registered Agent. A company shall also keep the minutes of the meetings and resolutions of members and minutes of meetings and resolutions of directors.

DirectorsThe business of a company is managed by the directors. A company must have at least one director. The first director shall be appointed by the Resident Agent, and subsequent directors may be appointed and removed by the members. A company shall keep a Register of Directors. A director shall act honestly and in good faith and in what he believes to be in the best interests of the company. The directors may meet outside the BVI. A quorum requires one half of the directors.

Registration of ChargesA company may create a charge over its property by an instrument in writing. The company must keep a Register of Charges at its Registered Office or at the office of its Registered Agent. The charge may also be registered in a Register of Registered Charges maintained by the Registrar, evidenced by a Certificate of Registration. A registered charge takes priority over a subsequently registered charges as well as unregistered charges.

Merger and ConsolidationThe directors of each company must approve a written Plan of Merger, which must be authorized by the members, and Articles of Merger must be executed by each company and filed with Registrar, following which a Certificate of Merger will be issued by the Registrar. A BVI company can merge with one or more BVI companies, or foreign companies, and the surviving company may be in the BVI or a foreign jurisdiction.

ContinuationA foreign company may continue to the BVI if the laws under which it is registered so authorize. The foreign company must file an Application to Continue, approved by a majority of its directors, and if approved the Registrar will issue a Certificate of Continuation. The continuation of a company does not affect the company as a legal entity, or the assets or liabilities of the company. A BVI company may redomicile or continue to another jurisdiction.

Liquidation and DissolutionA company may file for voluntary liquidation if it has no liabilities or it is able to pay its debts as they fall due. If it is insolvent, it must go into insolvent liquidation under the Insolvency Act 2003. If a company fails to appoint a resident agent, fails to file documents, or fails to pay annual fees, it may be struck-off the Register.

Registrations and FilingsA company must file a copy of its Register of Directors with the Registrar on a private or public basis. The Register of Members is not required to be filed with the Registrar. However, the Beneficial Owner Secure Search System Act (2017), known as BOSS, requires the Resident Agent to register Beneficial Owner information on the Boss system. The BOSS is a non-public database for law enforcement. A company must also meet the Economic Substance rules if it conducts a “relevant activity”, and make the appropriate filings.

Complaints Procedure

If, in the unlikely event, you encounter any problems with CISA Trust Company (BVI) Ltd.’s service which you are unable to resolve with your normal contact, you should raise the matter in writing to Ms. Cecilia Denis at cdenis@cisabvi.com, who will then make every effort to resolve the matter quickly and efficiently.

BVI Beneficial Ownership Secure Search System Act

BVI Annual Return: Your Guide to Financial Reporting Obligations

Do you have any inquiries?

Discover tailored trust solutions for individuals and financial advisors alike. Reach out to our experienced team for personalized guidance. Collaborate with us and pave the way to financial security!